How Can We Help?

A Fixed Asset Register is an accounting tool used to keep a list of various assets that a business owns. The purpose of maintaining a Fixed Asset Register is to keep track of the value of assets and determine depreciation to be calculated and recorded for management and taxation purposes. It is recommended that you update your Fixed Asset Register whenever you acquire a new asset, and when you dispose of an asset.

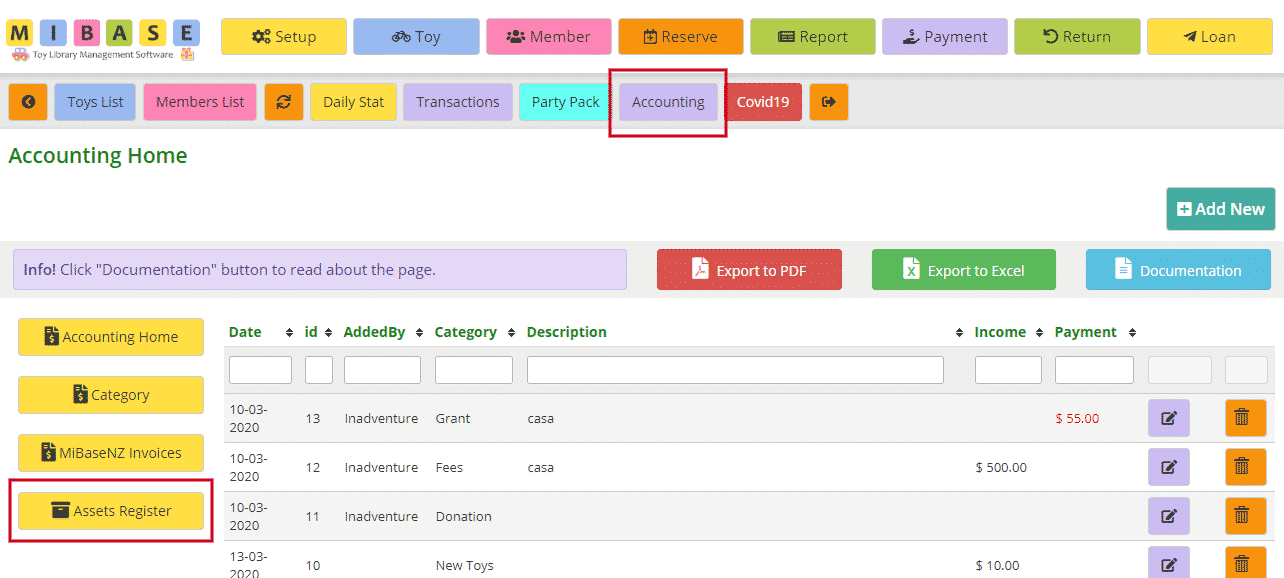

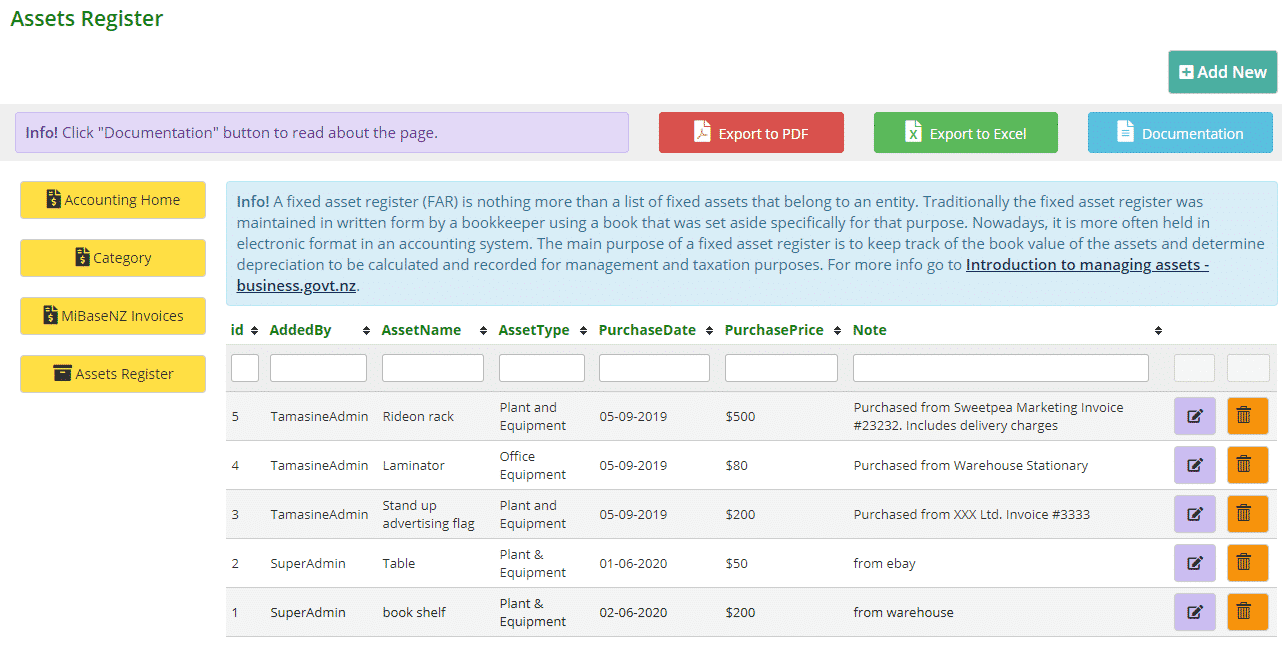

Within MiBaseNZ‘s Accounting module, you have the option to use an asset register for your toy library.

Go to Accounting -> Assets Register

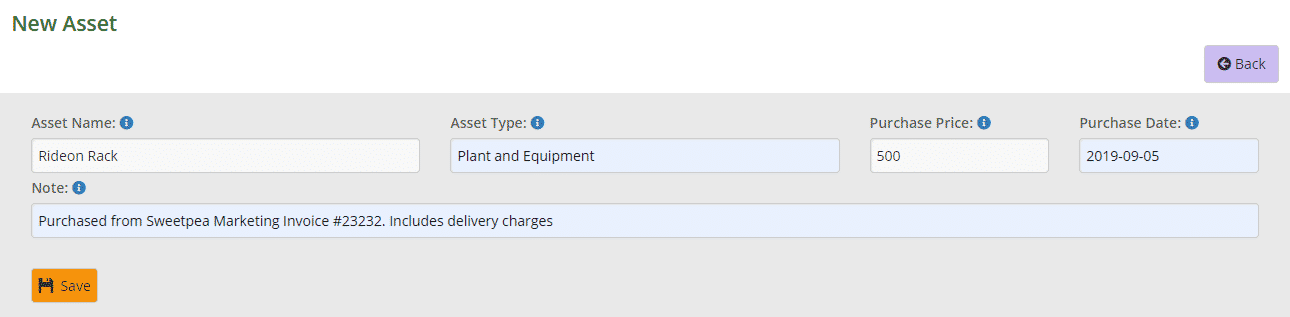

To start adding a new asset to the register, click on the “Add New” button.

Fill in all the fields. It is best to complete as much as you can. If there is any further information you would like to add, type it in the “Note” section.

Once done, click on the “Save” button.

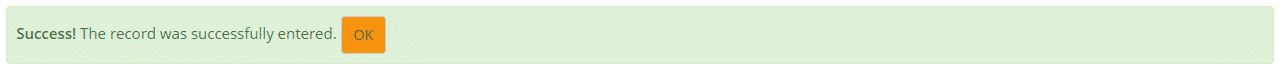

You will see the Success message appear underneath (an Error message may appear if there is a problem).

Continue adding your assets clicking “Save” after each one. When you have finished, click the “OK” button and it will take you back to the Assets Register home page.

You should now see a full list of all the assets you have added.

If you have made a mistake or would like to update an asset, click on the purple ![]() “Edit” button.

“Edit” button.

If you would like to delete an asset, click on the orange ![]() “Delete” button.

“Delete” button.

To sort or filter the list, click the arrows next to the heading you want to sort or filter the list by or type in the search boxes underneath the headings.

You can also download the list to PDF and/or Excel by clicking the “Export to PDF” or “Export to Excel” buttons. This will export the full list, not a filtered list. If you want to download a filtered list, export to excel and sort or filter through there.